Merck Pension: Should You Take the Lump Sum or Monthly Annuity?

By Jim McGowan, CFP®| Apollon Financial

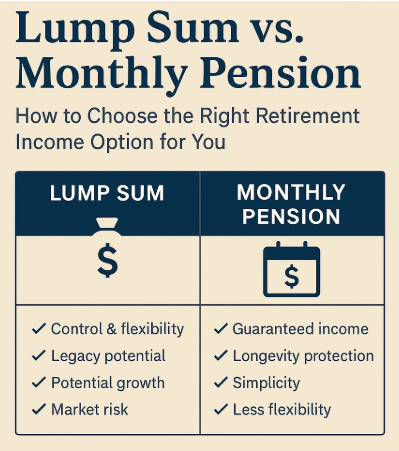

✅ Lump Sum: Flexibility with Responsibility

Pros:

- Control & Flexibility: You have full access to the funds and can manage them according to your goals—whether that’s investing, making large purchases, or estate planning.

- Legacy Planning: Any remaining funds can be passed to heirs.

- Potential Growth: If invested wisely (and aligned with your risk tolerance), the lump sum may provide higher long-term returns than the annuity.

Cons:

- Market Risk: You’re now responsible for managing the investment risk and making the money last.

- Longevity Risk: There’s a possibility of outliving your assets if not managed carefully.

- Tax Timing: Rolling into an IRA generally avoids immediate taxation, but withdrawals are still taxed as income.

✅ Monthly Annuity: Simplicity with Stability

Pros:

- Predictable Monthly Income: A steady monthly payment provides peace of mind and helps cover fixed expenses, like housing and health care.

- Longevity Protection: Payments last as long as you (or your spouse) live, reducing the risk of outliving your savings.

- Simplicity: No need to manage a large portfolio.

Cons:

- Less Flexibility: Once you choose the annuity, you can’t access the lump sum. That can limit your ability to handle large expenses.

- Inflation Risk: Unless the annuity has a cost-of-living adjustment, the buying power of your payments may decline over time.

- No Inheritance: Payments usually stop when you (or your joint annuitant) pass away—nothing goes to heirs unless you elect specific survivor options.

🔍 Personalized Considerations for Merck Employees

- Age & Health: Longer life expectancy may favor annuity. Health concerns may tilt toward lump sum.

- Spousal Needs: Does your spouse need continued income? Joint-and-survivor annuity or life insurance might factor in.

- Current Assets: A well-funded 401(k) or other assets might support taking the annuity. Leaner savings might require lump sum control.

- Tax Strategy: Your future tax bracket, RMDs, and timing of Social Security all matter in structuring a smart withdrawal plan.

- Emotional Fit: Some prefer control, others value simplicity—your comfort level counts.

Would you like help running the numbers or reviewing your Merck pension estimate through the lens of your entire financial planning picture? When we work together to create a plan I model both options side by side to show which one aligns best with your goals and values.

📅 Click here to schedule a quick call with me.

📍 Virtual meetings available for anyone throughout the United States. Serving local clients in Pennsylvania, New Jersey, Rahway, Lansdale, North Wales, Gwynedd, West Point, Doylestown, Blue Bell, Montgomery and Bucks County.

🧠 Related Resources

Apollon Financial, LLC (“Apollon”) provides advice and makes recommendations based on the specific needs and circumstances of each client. For clients with managed accounts, Apollon Wealth has discretionary authority over investment decisions. Investing involves risk and clients should carefully consider their own investment objectives and never rely on any single chart, graph, or marketing price to make decisions. The information contained herein is intended for information purposes only, is not a recommendation to buy or sell any security and should not be considered investment advice. Please contact your financial advisor with questions about your specific needs and circumstances. When making any tax or legal decisions clients should always seek out specific professionals such as legal counsel or a CPA. This piece is provided for information only and is in no way tax advice. While every effort has been made to ensure accuracy, only the IRS tax code itself should be considered official. Apollon does not file taxes for any clients. We attempt to track ESG mandates, but it may not always be possible to adhere to the stated guidelines. ESG performance may not be in line with other asset classes of the same type due to the focus on corporate governance