By Jim McGowan, CFP® When you’re buying a home, whether it’s your first or your fifth, the mortgage process can feel overwhelming. With all the moving pieces—credit scores, interest rates,…

By Jim McGowan, CFP® When you’re buying a home, whether it’s your first or your fifth, the mortgage process can feel overwhelming. With all the moving pieces—credit scores, interest rates,…

Donor-Advised Funds for Charitable Tax Deductions By: Jim McGowan, CFP® It’s that time of year again when everyone starts scrambling for year-end tax strategies. One tool more families are starting…

Making the Most of your Merck 401(k): How the Spillover Election and Automatic Roth Conversion Work Together By Jim McGowan, CFP® For Merck employees, understanding the details of your 401(k)…

How Interest Rates Impact Your Merck Lump Sum Pension Payout By Jim McGowan, CFP® Thinking about taking your Merck pension as a lump sum? Before you lock in that decision,…

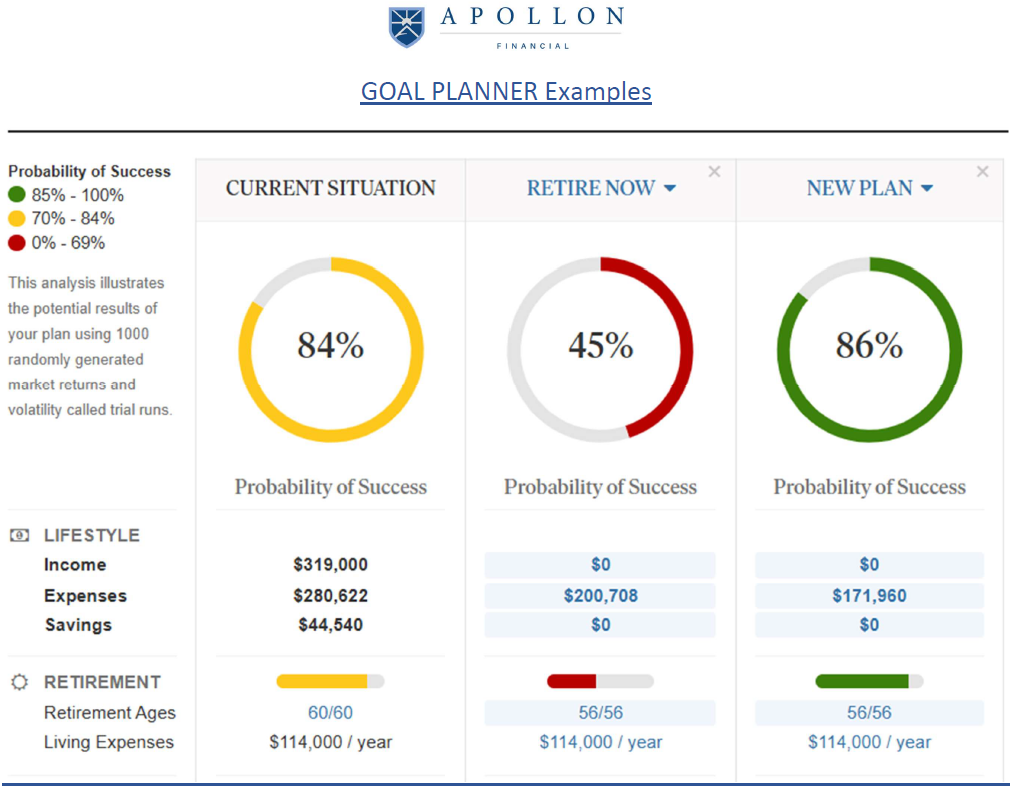

Here’s the truth: Nobody wakes up excited to build a retirement plan. 𝗕𝘂𝘁 𝗵𝗲𝗿𝗲’𝘀 𝘄𝗵𝗮𝘁 𝗽𝗲𝗼𝗽𝗹𝗲 𝗱𝗼 𝗰𝗮𝗿𝗲 𝗮𝗯𝗼𝘂𝘁: ✅ Not being a burden on their kids ✅ Avoiding the…

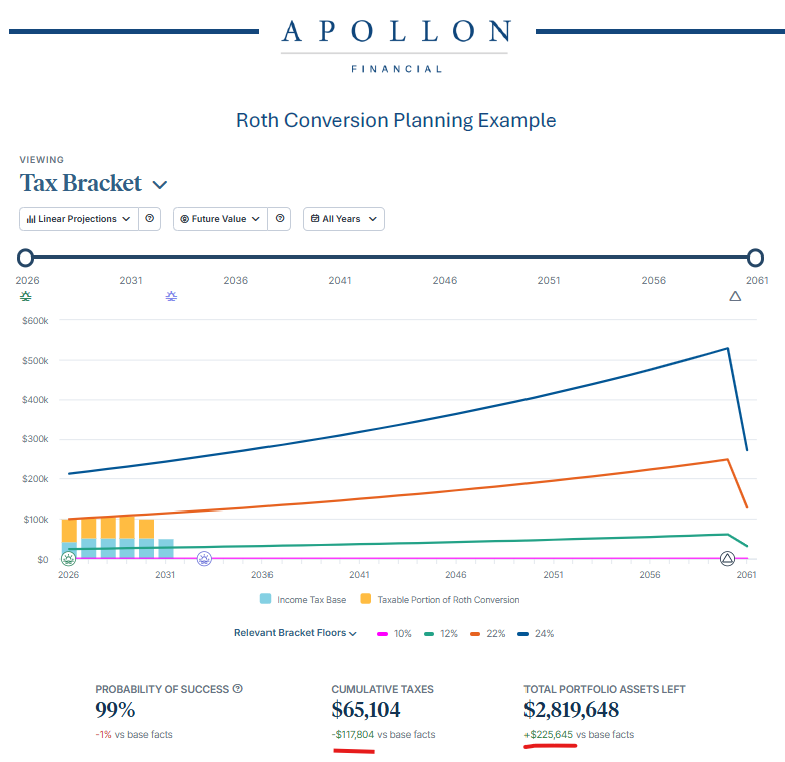

Roth Conversions: Smart Planning or Tax Trap? By Jim McGowan, CFP®| Apollon Financial “Should I Do a Roth Conversion?” That’s a common question I hear from so many people, especially…

Merck Pension: Should You Take the Lump Sum or Monthly Annuity? By Jim McGowan, CFP®| Apollon Financial ✅ Lump Sum: Flexibility with Responsibility Pros: Control & Flexibility: You have…

What Every Merck Employee Should Know About Your Pension By Jim McGowan, CFP® INTRODUCTION As a Merck employee, your pension is a significant piece of your retirement picture. Yet with…

Five years ago, I was interviewed on NBC Morning News during one of the most turbulent times in modern history. The pandemic was disrupting lives, rattling markets, and challenging even…

Merck Announces Major Reorganization According to Merck, CEO Rob Davis recently shared plans for a multiyear “optimization initiative,” aiming to reallocate $3 billion in annual resources by 2027. The goal?…