Backdoor Roth Contributions — How To Do Them Right

By Jim McGowan, CFP®| Apollon Financial

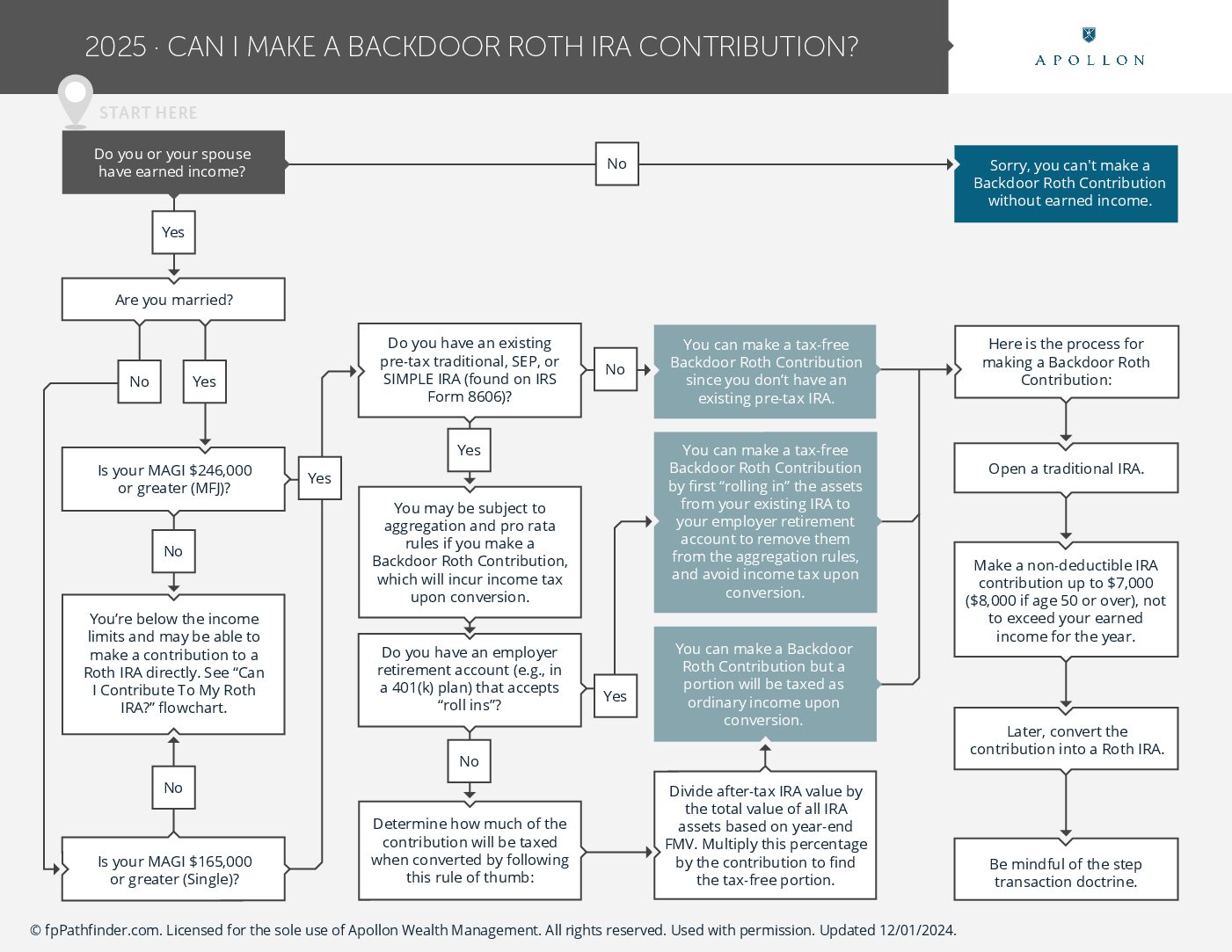

Roth IRAs are a smart way to build tax-free retirement income. But if your income is too high to contribute directly, the Backdoor Roth strategy can be a great workaround — when done correctly.

Unfortunately, I’ve seen too many people, accountants and even advisors trip over the details. The steps seem simple, but there are common pitfalls, including potential pro-rata tax liabilities.

Have questions?

✅ Click Here to download the complete flow chart to guide you on making Backdoor Roth contributions the right way.

📅 Click here to schedule a quick call with me.

📍 Virtual meetings available for anyone throughout the United States. Serving local clients in Pennsylvania, New Jersey, Rahway, Lansdale, North Wales, Gwynedd, West Point, Doylestown, Blue Bell, Montgomery and Bucks County.

🧠 Related Resources

- Pre-Tax vs. Roth 401(k): Does it Really Matter?

- Merck Pension: Should you take the Lump Sum or Monthly Annuity?

This post is for informational purposes only and not individual tax or investment advice. Always consult your own advisor regarding your specific situation.