After-tax 401(k) contributions are a lesser-known retirement savings strategy that can significantly boost your nest egg. Here’s what you need to know:

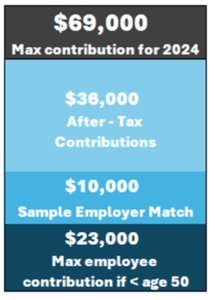

Max contribution to your 401(k) for 2024 = $69,000

What are After-Tax 401(k) Contributions?

After-tax 401(k) contributions are made with money that has already been taxed, unlike traditional pre-tax or Roth 401(k) contributions. They’re separate from and in addition to your regular 401(k) contributions.

Key Benefits:

- Higher Contribution Limits: After-tax contributions can help you save beyond the standard 401(k) limits.

- Potential for Tax-Free Growth: When combined with a Roth conversion strategy, your earnings can grow tax-free.

- Flexibility: You can withdraw your after-tax contributions (but not earnings) at any time without penalties.

How It Works:

- Contribute after-tax dollars to your 401(k).

- Your contributions grow tax-deferred.

- Upon withdrawal, you pay taxes only on the earnings, not the principal.

The Mega Backdoor Roth Strategy:

Some plans allow you to convert after-tax contributions to a Roth account or process an in-service distribution, enabling tax-free growth on future earnings. This is known as the “Mega Backdoor Roth” strategy.

Considerations:

- Not all 401(k) plans offer this option.

- There are specific IRS rules and limits to be aware of.

- It’s crucial to understand your plan’s specific rules and options.

Conclusion:

After-tax 401(k) contributions can be a powerful tool for high-income earners or those looking to maximize their retirement savings. However, it’s complex and may not be suitable for everyone. Consult with a financial advisor to determine if this strategy aligns with your retirement goals.

Disclosure:

Advisory services are provided by Apollon Financial, LLC (“Apollon”), an investment adviser registered with the Securities and Exchange Commission. Apollon Financial does not assist with tax filing or legal advise. The information in this message is for the intended recipient[s] only. You can find important disclosures by visiting our website www.apollonfinancial.com or by clicking on the following