Roth Conversions: Smart Planning or Tax Trap?

By Jim McGowan, CFP®| Apollon Financial

“Should I Do a Roth Conversion?”

That’s a common question I hear from so many people, especially professionals at companies like Merck who are managing complex benefits and preparing for retirement.

And while Roth conversions can offer significant long-term benefits, they’re not a one-size-fits-all solution.

💡 What Is a Roth Conversion?

A Roth conversion means moving money from a traditional IRA or 401(k) into a Roth IRA. You pay income tax on the converted amount now and then enjoy potential tax-free growth and tax-free withdrawals in retirement.

It sounds great—and it can be.

But only if the numbers add up.

✅ When Roth Conversions Make Sense

Here are some common scenarios where a Roth conversion could work to your advantage:

- You’re in a temporarily low tax bracket

- Markets are down and your account values have dipped

- You want to reduce future RMDs

- You want to leave tax-free assets to your beneficiaries

- You’re trying to manage your future Medicare premiums (IRMAA)

⚠️ When to Think Twice

That said, a Roth conversion could cost you more than it helps if:

- You don’t have outside cash to pay the taxes

- You’ll need the funds within 5 years (early withdrawal penalties may apply)

- Your Medicare or ACA benefits could be impacted by higher income

- You’re planning Qualified Charitable Distributions (QCDs)

- Your heirs are likely to be in lower tax brackets

Every one of these factors can change the math. That’s why Roth conversions should be analyzed annually—not guessed at or done just because “it feels right.”

🔍 Why This Isn’t a One-Time Decision

Many people assume that if a Roth conversion made sense last year, it still does today.

But your life changes. So do tax laws.

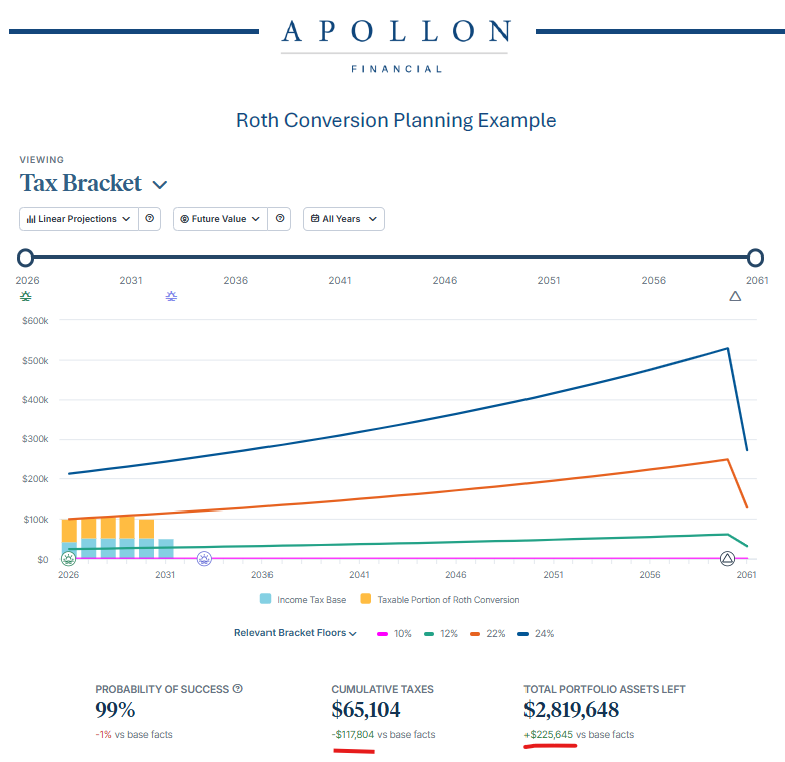

That’s why at Apollon Financial, we use financial planning and tax projection software to revisit the Roth decision every year.

We evaluate:

- Your current and projected tax bracket

- Your expected retirement timeline

- Your health care costs and benefits

- Charitable and estate planning goals

- Your long-term income needs

📊 Why Merck Professionals Need to Be Strategic

If you’ve spent years building up traditional retirement savings, you may face significant tax liability on those accounts later in life.

Roth conversions may help you spread out the tax hit and control your future income, especially in the years before RMDs begin.

We work with Merck employees to align Roth conversion timing with retirement goals, pension options, stock compensation, and estate planning.

🧩 Roth Conversions Are Just One Piece of the Puzzle

Roth conversions aren’t a standalone strategy. They need to be coordinated with your full financial plan, including:

- Retirement income strategy

- Tax-efficient withdrawal planning

- Estate and beneficiary planning

- Charitable giving

- Long-term health care costs

📅 Click here to schedule a quick call with me.

📍 Virtual meetings available for anyone throughout the United States. Serving local clients in Pennsylvania, New Jersey, Rahway, Lansdale, North Wales, Gwynedd, West Point, Doylestown, Blue Bell, Montgomery and Bucks County.

🧠 Related Resources

- Backdoor Roth Contributions – How to do them Right

- Pre-Tax vs. Roth 401(k): Does it Really Matter?

- Merck Pension: Should you take the Lump Sum or Monthly Annuity?

Apollon Financial, LLC is a registered investment advisor. This article is for informational purposes only and should not be considered tax or investment advice. Consult your tax professional before making any financial decisions.