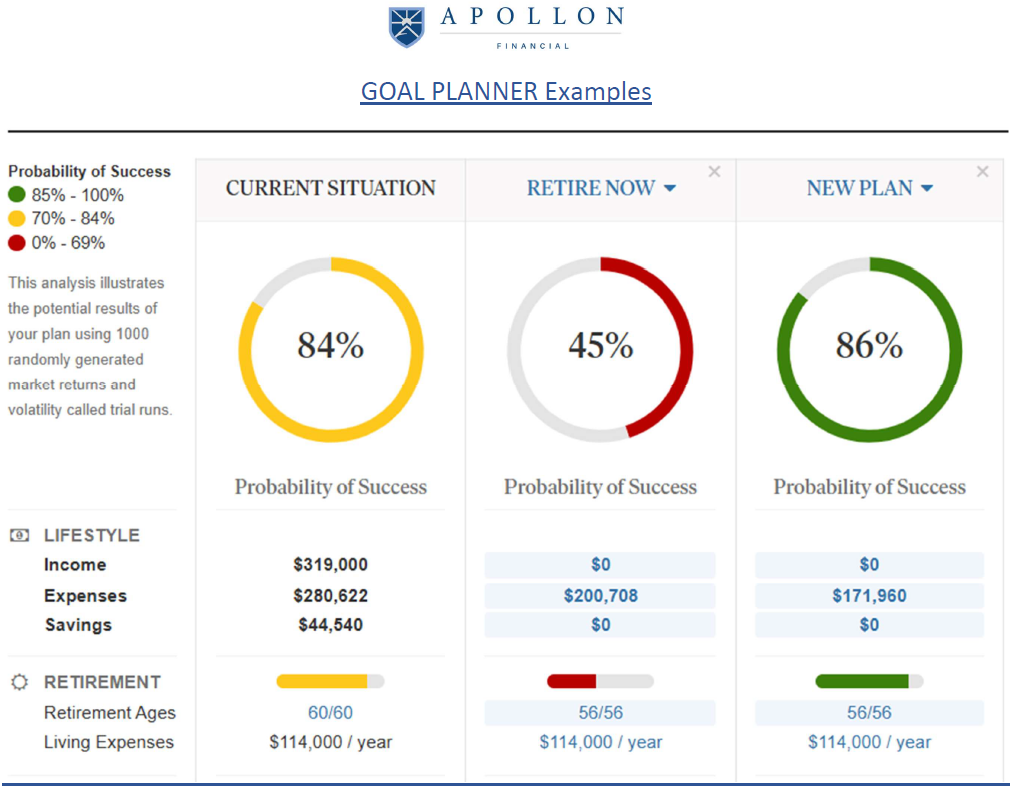

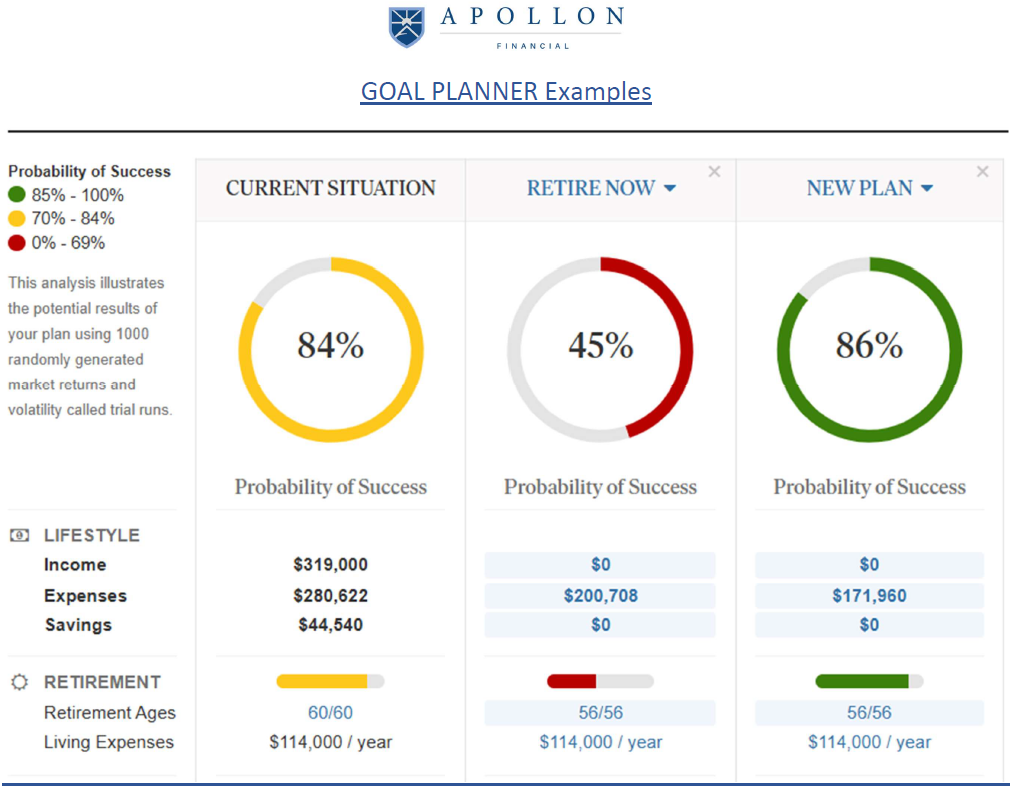

When most people hear “retirement planning,” they think about one thing—saving enough. But real retirement planning is so much more than setting a number. It’s about aligning your finances with the life you want to live, both now and in the future.

As a financial professional, I don’t just hand my clients a document and call it a day. We work together to create a strategy that fits their life—discussing different options, deciding what feels right at the time, and making adjustments as life evolves.

Start With the Life You Want

Retirement planning begins with a simple question: What do you want your life to look like now and when you’re no longer working full-time? Maybe you want to travel more. Volunteer. Spend time with grandkids. Or launch a second act doing something different.

Once you know what you’re working toward, we can start shaping your finances to support that vision. It’s not just about reaching a number—it’s about designing a sustainable income strategy that fits your lifestyle and goals.

Your Income Plan Should Be as Strong as Your Savings Plan

Yes, saving and investing are essential. But just as important is figuring out how to turn your savings into income you won’t outlive. That means coordinating withdrawals from:

- Your 401(k) and any IRAs

- Roth accounts

- Stock options or RSUs

- Pensions (if applicable)

- Social Security

The order and timing of these withdrawals can significantly impact how much you pay in taxes and how long your money lasts.

Make Taxes Work in Your Favor

A solid retirement plan includes proactive tax strategies. For example, we often explore Roth conversions (which trigger taxable income in the year of conversion) during lower-income years, or coordinate withdrawals to help minimize your tax bracket over time. These decisions can make a meaningful difference in what you keep.

Don’t Forget the “What-Ifs”

Life is full of change—markets shift, healthcare costs rise, laws evolve. A good retirement plan adapts with you. That’s why we revisit your plan regularly to help keep you on track.

We also plan for what happens if something unexpected occurs—such as a premature retirement, long-term care needs, or a change in family structure. Planning for the unexpected brings confidence, not just for retirement, but for the journey there.

You Don’t Have to Figure It All Out Alone

At Apollon Financial, we take a full-service approach. I help coordinate strategies for your investments, benefits, insurance, taxes, and estate documents—so everything is working together to support your goals. You get more than a spreadsheet. You get a strategy that is aligned with your goals.